Recycling

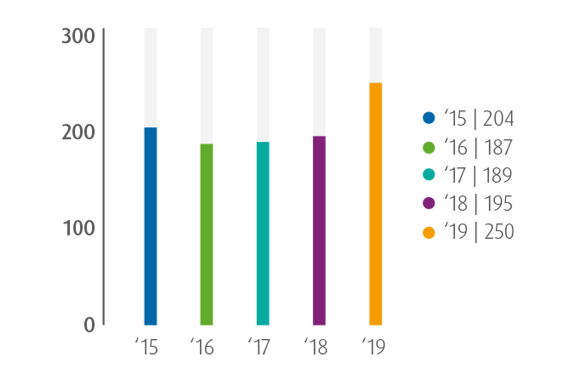

Millions of Euros

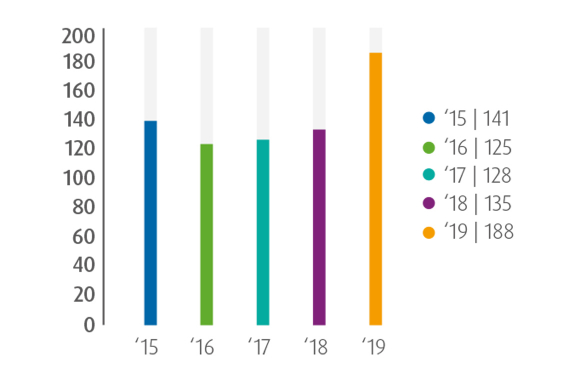

Recycling recorded revenues of € 681 million and a recurring EBIT of € 188 million in 2019, an increase of 9% and 40% respectively compared to 2018. The business group results were supported by higher metal prices. In addition, Precious Metals Refining benefitted from a favorable supply environment and optimized our input mix, offsetting most of the impact of the extended shutdown and the fire incident in July. Recurring EBITDA amounted to € 250 million, an increase of 29% compared to 2018.

Revenues and earnings for Precious Metals Refining were well up from 2018 benefitting from improved market conditions in certain supply segments and higher metal prices. Processed volumes were lower than in 2018 due to the extended maintenance shutdown of the Hoboken plant in the beginning of 2019. In addition, the overall availability of the smelter was affected by the fire incident in July. Umicore was able to offset most of the volume shortfall by optimizing the input mix.

Millions of Euros

The metal price environment was supportive in 2019, with increasing prices for certain precious and platinum group metals, particularly in the second half of 2019. While Umicore had already locked in a significant portion of our exposure to these metals in the first half of 2019 and could therefore not fully benefit from the rise in the second half of 2019, average received prices for these metals in 2019 were nevertheless well above the levels of 2018.

The availability of complex secondary materials increased, in particular end-of-life materials such as spent automotive catalysts with a higher metal loading than previous generations and a growing portion of diesel particulate filters. More printed circuit boards were available for recycling as a result of the stricter enforcement by the Chinese government of the Green Fence. We made full use of our distinctive technological capabilities to recycle a higher proportion of such complex materials. This optimization of the mix offset most of the volume shortfall in 2019.

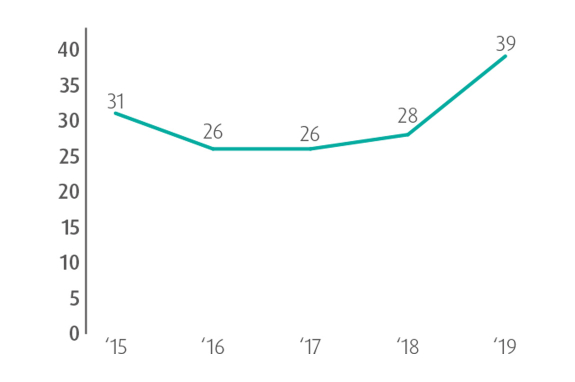

%

The multi-year capacity expansion program at the Hoboken plant has now been completed and the focus will be to ensure maximum availability of the equipment and optimize the use of this expanded capacity in line with the supply opportunities in the market. As part of our continuous programs to improve the environmental performance of the Hoboken plant, Umicore carried out several investments aimed at upgrading existing plant facilities.

Revenues for Jewelry & Industrial Metals remained stable compared to 2018. The activity benefitted from higher market demand for silver coins, market share gains in our refining and recycling activities and continued strong demand for our performance catalysts. Order levels for our jewelry and industrial products were lower from 2018.

The earnings contribution from Precious Metals Management increased substantially compared to 2018 as the business unit benefitted from favorable trading conditions for precious and certain platinum group metals.