Energy & Surface Technology

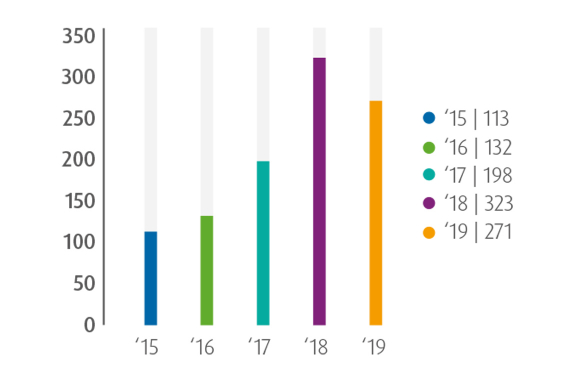

Millions of Euros

Revenues in Energy & Surface Technologies amounted to € 1,225 million, down 5% from the record levels in 2018, reflecting the impact of lower metal prices, reduced sales of high cobalt containing products and lower sales of cathode materials for high-end portable electronics and energy storage. Sales of Umicore’s cathode materials used in automotive applications, however, grew in line with the global EV market, which was up 7.7%, supported by our exposure to a diverse mix of EV platforms with OEMs globally. Revenues and margins were severely impacted by the collapse of the cobalt price, which on average more than halved compared to 2018 and drove the cobalt refining, recycling and distribution margins much lower compared to the historically high levels of 2018. We integrated the cobalt and nickel refining activities that directly feed the cathode materials production plants in our Rechargeable Battery Materials business unit. The inflow of cheaper cobalt units unethically sourced from artisanal mining, which put our high cobalt-containing products at a competitive disadvantage, continued to impact the performance of the business group.

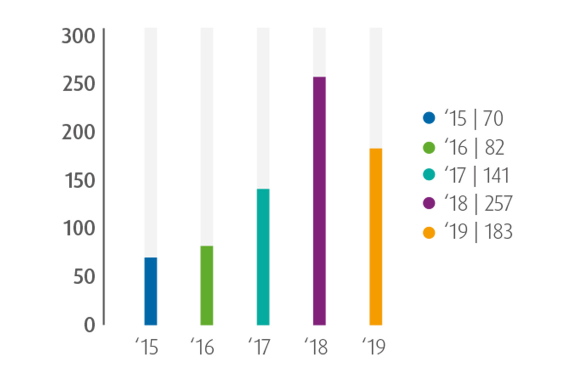

Millions of Euros

Recurring EBIT was well under the levels achieved in 2018 (-29%) and amounted to € 183 million.

This decrease also reflects higher depreciation charges from recent investments and costs related to greenfield investments in China and Poland. Recurring EBITDA was € 271 million, down 16% from 2018.

Visibility remains limited, in particular in China where EV demand is not expected to materially recover in 2020. We anticipate benefitting from the consolidation of the recently acquired cobalt refining and cathode precursor activities in Kokkola, Finland. At the same time, the performance of the business group will reflect higher fixed costs, such as depreciation charges and upfront costs, related to the ongoing investments in capacity as well as higher R&D spending.

To align with the metric most commonly used in the rechargeable battery market and incorporate the evolution of the chemistry mix, we decided to express our projections in GWh rather than in tons of cathode materials. We expect to reach 60 GWh of cathode materials capacity by mid-2021 and 100 GWh by mid- 2023, in line with the revised projections.

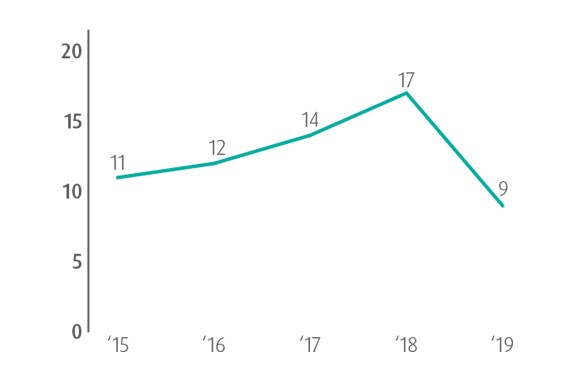

%

Revenues in Rechargeable Battery Materials were down compared to 2018 due to lower sales of high- energy LCO cathode materials for high-end portable electronics and reduced demand for NMC cathode materials used in energy storage applications. Sales volumes of NMC cathode materials to power EV applications grew in line with the global EV market, supported by our exposure to a diverse mix of EV platforms with OEMs globally. Our overall sales volumes of cathode materials in the second half of 2019 exceeded both the levels of the first half of 2019 and the second half of 2018.

In 2019, the global EV market slowed down with demand for full electric and plug-in hybrid vehicles up 7.7% after an impressive 62% year-on-year growth in 2018. While EV sales continued to grow in the first half of 2019, albeit at a slower pace than in the second half of 2018, sales decreased in the second half of 2019 due to an abrupt decline of EV demand in China once the subsidy cuts had taken their full effect at the end of June. The new subsidy regime was also less supportive for the use of NMC cathode material in e-buses for shorter distance public transport. Despite the near-term weakness in demand, EV sales in the region are expected to increase substantially over the next years, as the Chinese government remains fully committed to pushing forward electrified transportation. The Ministry of Industry and Information Technology recently proposed a new target penetration rate of 25% NEVs in 2025 (up from 20% previously and compared with a penetration rate of less than 5% in 2019) combined with an increase of the NEV credit targets for the period 2021-2023.

EV sales in Europe continued to grow strongly by 30% in 2019 with car OEMs increasingly electrifying their products to anticipate new CO2 emission regulation and super credits both phasing-in in 2020. Europe accounted for 26% of EVs sold globally and its share is expected to increase over the coming years. The proposed European Green Deal provides another strong push towards electrification with the introduction of more stringent CO2 targets to ensure a clear pathway from 2025 towards zero- emission mobility.

2019 was a challenging year in terms of EV demand but several regions are transitioning to electrified mobility. We reached major milestones that strengthen our global positioning as a battery materials supplier to support this transition. Umicore commissioned the new Process Competence Center in Olen, Belgium and started construction of our greenfield production site in Poland, due to start production by the end of 2020. Umicore also started commissioning our new site in China, with an adjusted schedule for further line additions due to the current market slowdown. We also signed multi-year agreements with leading EV battery makers LG Chem and Samsung SDI for the supply of respectively 125,000 and close to 80,000 metric tons of cathode materials, starting in 2020. In 2019 we expanded our integrated and sustainable battery materials value chain by acquiring Freeport Cobalt’s cobalt refining and cathode precursor activities in Kokkola, Finland, in early December, and by concluding a long-term partnership with Glencore for the supply of sustainable cobalt. Our suppliers source Cobalt from state-of-the-art industrial-scale concessions in the DRC, which operate in full conformity with our Sustainable Procurement Framework for Cobalt and supply our refineries worldwide, including the Kokkola refinery.

Umicore obtained support for 3 projects within the framework of Important Projects of Common European Interest (“IPCEI”1F) for batteries. The Umicore IPCEI- projects are focused on research, innovation and first industrial deployment for new products and processes that are crucial to produce high-quality and affordable batteries that can be recycled in a safe and environmentally friendly way.

Demand for NMC materials used in energy storage applications in Korea came to a complete standstill in the first half of 2019 when the government halted the production of new systems after a series of safety incidents. Demand for cathode materials going into this application has remained subdued since then. Umicore’s sales of High Energy LCO cathode materials for batteries in high-end portable electronics decreased due to high inventory levels in the supply chain and competition from products containing cheaper cobalt sourced unethically from artisanal operations.

Revenues and margins of Cobalt & Specialty Materials were significantly impacted by the lower cobalt price and the impact of cheaper cobalt from unethical artisanal mining which led to lower volumes and margins in most cobalt-related activities. Demand for cobalt-containing products was weak as customers were reducing excess inventories built up in 2018 when the cobalt price averaged more than double the price in 2019. Volumes and premiums of these products were impacted by the inflow of cheaper cobalt which is unethically sourced from artisanal mining, enabling several competitors to sell at a lower price. While the low cobalt price encouraged some diggers to step away from artisanal cobalt mining, a large stock overhang of such cobalt units is still feeding the market today. Margins in the distribution activity were also impacted by the lower cobalt price while volumes grew thanks to a successful geographical expansion.

Revenues for nickel compounds used in the battery, plating and catalyst industries were slightly higher than 2018. Due to a challenging market environment, Umicore decided to discontinue operations at our cobalt, nickel and rhenium refining and recycling plant in Wickliffe, OH, US. The plant transformed these metals into compounds for the catalyst, petrochemical refining and aviation industries. The recycling of cobaltcontaining scrap will be taken over by the refining and recycling plant in Olen, Belgium. The other activities will be phased out in the course of 2020.

Revenues for Electroplating were slightly up from 2018 benefitting from higher demand for our technologically advanced precious metal-based electrolytes used in portable electronics. Demand for jewelry and decorative applications, however, was substantially lower due to the economic slowdown and as these industries reduced their metal consumption owing to fast-rising precious metal prices.

Revenues for Electro-Optic Materials were roughly stable compared to 2018. A higher contribution to revenues from finished infrared optics and germanium recycling and refining compensated for the impact of lower demand for thin film products from the microelectronics industry. Revenues for substrates remained broadly stable.